Rick Ackerman grew up in Margate and is a 1967 graduate of Atlantic City High School. He began his career as a reporter for the Press of Atlantic City. He then moved to San Francisco where he was a floor trader and options dealer on the Pacific Stock Exchange for many years. Today, he is a trader and “chartist”. He publishes “Rick’s Picks”, a financial newsletter. He also teaches his “hidden pivot” method to analyze investment trends.

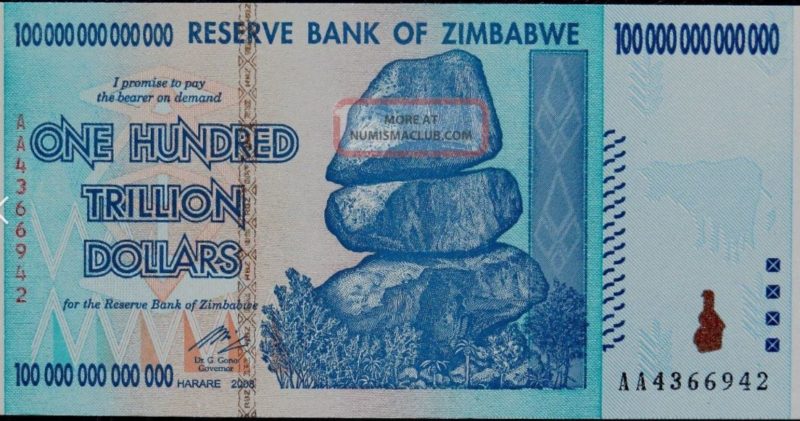

Many economists predict that the United States economy is rapidly looking like the economy of Zimbabwe (formerly Rhodesia) in 2007. At that time, the government began spending far more than it took in. It paid for what it needed by printing paper currency that was not backed by anything of value. As the currency became worth less, people demanded more and more of it for the work they did or goods they sold. By 2008, the inflation rate per year had reached 231 million percent. By 2009, the Bank of Zimbabwe begain issuing One Hundred Trillion Dollar notes, which paid for little more than a loaf of bread. As the United States government continues to spend trillions of dollars that it doesn’t have, many economists predict the dollar will become almost worthless and that inflation will raise prices to levels approaching those in 2009 Zimbabwe. Those who expect inflation would borrow heavily today, so they can pay their debts in the future with dollars that will have much less value. However, others predict that the opposite will happen. They claim that prices will greatly decline and that the dollar will greatly increase in value. Those who borrow heavily today will be forced to pay back their debts with much more expensive dollars. That is called “deflation” and that is what caused the Great Depression in the 1930’s. It also happened after the “Panic of 1837”, America’s first economic collapse. How can that be?

Here is what Rick Ackerman has to say. Ackerman grew up in Margate and is a 1967 graduate of Atlantic City High School. He began his career as a reporter for the Press of Atlantic City. He then moved to San Francisco where he was a floor trader and options dealer on the Pacific Stock Exchange for many years. Today, he is a trader and “chartist”. He publishes “Rick’s Picks”, a financial newsletter. He also teaches his “hidden pivot” method for analyzing investment trends. Here is an excerpt from his latest post on the subject. Click here for his full post at Rick’s Picks – Rick Ackermen – Ricks Picks (rickackerman.com).

“Predictions of massive “hyperinflation” flatly contradicts a forecast I’ve held to for decades – i.e., that deflation would ultimately wreck the global economy, driving the dollar into such scarcity that many, if not most, Americans will have to barter to survive. This may seem hard to believe at the moment, given the Fed’s reckless monetary blowout and the illusory prosperity it has created. Most of the virtual money has gone into investable assets, triggering a historical run-up in stocks during a year of Covid lockdowns. It has also created a real estate bubble even more extreme than the one that popped in 2008, nearly taking the global economy with it.

This Isn’t the 1970s

“We should note that the current inflation is very different from the one of the 1970s. That was self-perpetuating to the extent wages and prices drove each other higher in a seemingly endless spiral. The current inflation is not self-perpetuating; rather, it is being driven by an increase in paper wealth that will reverse and crash in the next bear market. Nor are people desperate to trade dollars for physical assets, as occurs in a hyperinflation; mainly, it has been Baby boomers spending a significant portion of their paper wealth on second homes in desirable locations away from urban centers.

“Still, one might ask: With the Fed and every other central bank inflating like there’s no tomorrow, how could deflation possibly result? The answer lies in the inescapable fact that every penny of what we collectively owe must ultimately be repaid –if not by the borrower, then by the lender. This implies, for one, that when Biden and the Democrats “forgive” student loans amounting to $1.7 trillion, creditors will eat the entire loss. Twelve zeroes worth of receivables will be wiped from their books with the stroke of the President’s pen; shortly thereafter, yacht prices will begin to soften in West Palm Beach, and the market for $20+ million homes in the Hamptons will appear to totter, producing tremors in Aspen, Scarsdale and Atherton.

“Now imagine this implosion multiplied a hundredfold. That’s what will happen when the inevitable bear market in stocks unfolds. It will suck many more digital dollars into a black hole of deflation than the Fed could conceivably monetize in an unrehearsed attempt to hold off a collapse. The deleveraging will not stop until it has reduced the $2 quadrillion financial derivatives market to an infinitely dense singularity. A thousand financiers working 24/7 and backed by the full faith and credit of the U.S. Government will not be able to pry loose even a dime of credit from that market for at least a decade. That’s how long it will take, at a minimum, for a wrecked middle class to push their credit scores back above 400.

Dollar Short-Squeeze

“The collapse will end our misplaced faith in a bank clearing system that is as fragile as Delft pottery, rendering ATMs and credit cards useless overnight. Money markets will seize up as lenders refuse to roll overnight loans, instead demanding settlement in cash. That’s when we will discover that real cash-dollars are actually in short supply. In the absence of a functioning market for digital dollars, the resulting short-squeeze on real ones will be like the one that pushed the shares of Gamestop and AMC into the stratosphere. The comparison is appropriate because, like debt issued by those two companies, the dollar ultimately is just a worthless I.O.U.

“For the time being, however, the dollar will remain under pressure despite assurances from Fed bag-man Jerome Powell that inflation has peaked. We should note, however, that the dollar has not exactly collapsed under the weight of wantonly reckless Fed stimulus. To the contrary, and as the chart above makes clear, the greenback is down just 4% from the sweet spot of its pre-pandemic trading range. Moreover, a key, long-term support at 90 has survived two brutal shakedowns this year. Although the support could conceivably give way on renewed selling, nothing in the chart says this is likely, let alone that the dollar is in a condition of imminent collapse. . . ”

The proposed Atlantic County Authority “revenue bonds” for Blatstein’s Water Park is a perfect example of Rick Ackerman’s theory. Investors who buy $95 million of those bonds will at first appear to be very wealthy. They will be receiving very high interest on those bonds every three months. Because they will have high income, they will spend freely and drive up the prices of everything they buy. However, if the project fails and they lose their entire investment, they will be broke. Especially if they stop getting monthly payments from insolvent pensions, and lose money on other investments. If they and everyone else who is suddenly broke are unable to buy anything or even go out to restaurants, prices will fall as “deflation” sets in.

Finally, both New Jersey and America have been here before. It 1837, there was a devastating six year economic collapse that threatened the survival of America. It was caused by state and local government borrowing massive amounts of money to build roads, canals, and other projects that failed to produce enough money to pay back the loans. Much of this was because of “systemic corruption” in state and local government. Because many banks invested in state and local bonds issued to pay for these projects, they failed when these bonds became worthless. Anyone who kept their savings in those banks lost everything. New Jersey and most other states responded to this disaster by adopting new state constitutions. These new constitutions made it very difficult for state and local governments to borrow money. They were so successful that until 1960, New Jersey state government was virtually debt free. All that changed in the 1960’s. That was when the New Jersey Supreme Court created loopholes in our state constitution. It allowed state and local government to set up independent “authorities” and other gimmicks to borrow money for pet projects indirectly. Click here for details on how and when this happened.

We are a group of roughly 200 citizens who mostly live near Atlantic City, New Jersey. We volunteer our time and money to maintain this website. We do our best to post accurate information. However, we admit we make mistakes from time to time. If you see any mistakes or inaccurate, misleading, outdated, or incomplete information in this or any of our posts, please let us know. We will do our best to correct the problem as soon as possible.

Also, because Facebook, Twitter, and other social media platforms falsely claim our posts violate their “community standards”, they greatly restrict, “throttle back” or “shadow ban” our posts. Please help us overcome that by sharing our posts wherever you can, as often as you can. Please click the social share links below. Also copy and paste the link to the “comments” section of your favorite sites like Patch.com or PressofAtlanticCity.com and email them to your friends. Thanks.

Seth Grossman, Executive Director

LibertyAndProsperity.com

(609) 927-7333