Above Image: Last week, New Jersey’s Democratic Governor Phil Murphy said “the state will make certain that Atlantic City casinos pay their fair share in taxes”. I responded by saying,

“Governor Murphy failed to even mention our State Constitution, which requires casino real estate to be assessed and taxed the same as all other real estate. Once again, this Governor is showing either ignorance or contempt for a document that he swore to comply with”.

Click here for link to full article published in PressofAtlanticCity.com on February 12, 2023. Gov. Murphy says casinos to pay ‘fair share’ as state appeals court rulings in 2 PILOT lawsuits (pressofatlanticcity.com)

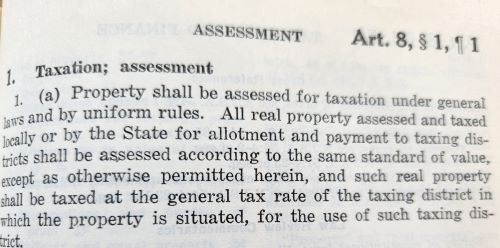

Since 1875, the New Jersey State Constitution required that all real estate, (with exceptions for farms, “blighted areas” and homes of veterans and senior citizens) be “assessed according to the same standard of value” and “taxed at the general tax rate of the taxing district in which the property is situated”. If state government respected and complied with our State Constitution, Atlantic City casinos would pay their “fair share” of real estate taxes without any special favors from the Governor.

However, in December of 2021, Governor Murphy and the New Jersey Legislature adopted a new “Payment In Lieu of Taxes” (PILOT) law that ignored our State Constitution. It reduced the real estate taxes paid by Atlantic City casinos by anywhere from roughly $22 to $55 million in the year 2022 alone. All other property owners in Atlantic County are paying higher real estate taxes to make up the difference.

Last January, our organization, Liberty and Prosperity 1776, Inc. filed a lawsuit to void that new “Payment In Lieu of Taxes” law for being unconstitutional. Judge Michael Blee of the Superior Court of New Jersey agreed, and ruled in our favor last August. However, Governor Murphy appealed that decision. We are waiting for a hearing before either the Appellate Division or the New Jersey Supreme Court.

If he wanted to, Governor Murphy could immediately make Atlantic City casinos pay their “fair share” of real estate taxes by simply withdrawing the state’s appeal, and complying with the August 29 decision of Judge Blee! And Article I, Section 8 of our New Jersey State Constitution!

LibertyAndProsperity.com is a tax-exempt, non-political education organization of roughly 200 citizens who mostly live near Atlantic City, New Jersey. We formed this group in 2003. We volunteer our time and money to maintain this website. We do our best to post accurate information. However, we admit we make mistakes from time to time. If you see any mistakes or inaccurate, misleading, outdated, or incomplete information in this or any of our posts, please let us know. We will do our best to correct the problem as soon as possible. Please email us at info@libertyandprosperity.com or telephone (609) 927-7333.

If you agree with this post, please share it now on Facebook or Twitter by clicking the “share” icons above and below each post. Please copy and paste a short paragraph as a “teaser” when you re-post.

Also, because Facebook and Twitter falsely claim our posts violate their “community standards”, they greatly restrict, “throttle back” or “shadow ban” our posts. Please help us overcome that by sharing our posts wherever you can, as often as you can. Please copy and paste the URL link above or from the Twitter share button to the “comments” section of your favorite sites like Patch.com or PressofAtlanticCity.com. Please also email it to your friends. Open and use an alternate social media site like Gab.com.

Finally, please subscribe to our weekly email updates. Enter your email address, name, city and state in the spaces near the top of our home page at Homepage – Liberty and Prosperity. Then click the red “subscribe” button. Or email me at sethgrossman@libertyandprosperity.com or address below. Thanks.

Seth Grossman, Executive Director

LibertyAndProsperity.com

info@libertyandprosperity.com

(609) 927-7333